![]()

![]()

![]()

![]()

![]()

![]()

![]()

DISCLAIMER:

I KNOW NOTHING AND I AM NOT A FINANCIAL PROFESSIONAL.

That being said I think understanding the social network that feeds humanity is monumentally important.

Nobody cares when their grocery store shelves are fully stocked (which I believe is truly a Miracle!), but when the chips are down and it takes a shopping cart full of money to buy a loaf of bread, the Economy becomes the most important topic in most peoples lives.

Please post any information on the Economy and Investing that you feel will help people.

I have been saying since the Super Bowl the Stock Market is coming due for a pull back, even though I think it will end the year positive. I think we may see some selling in the next few weeks or months. Its been a bit of a melt up, on the backs of only a few draft horses.

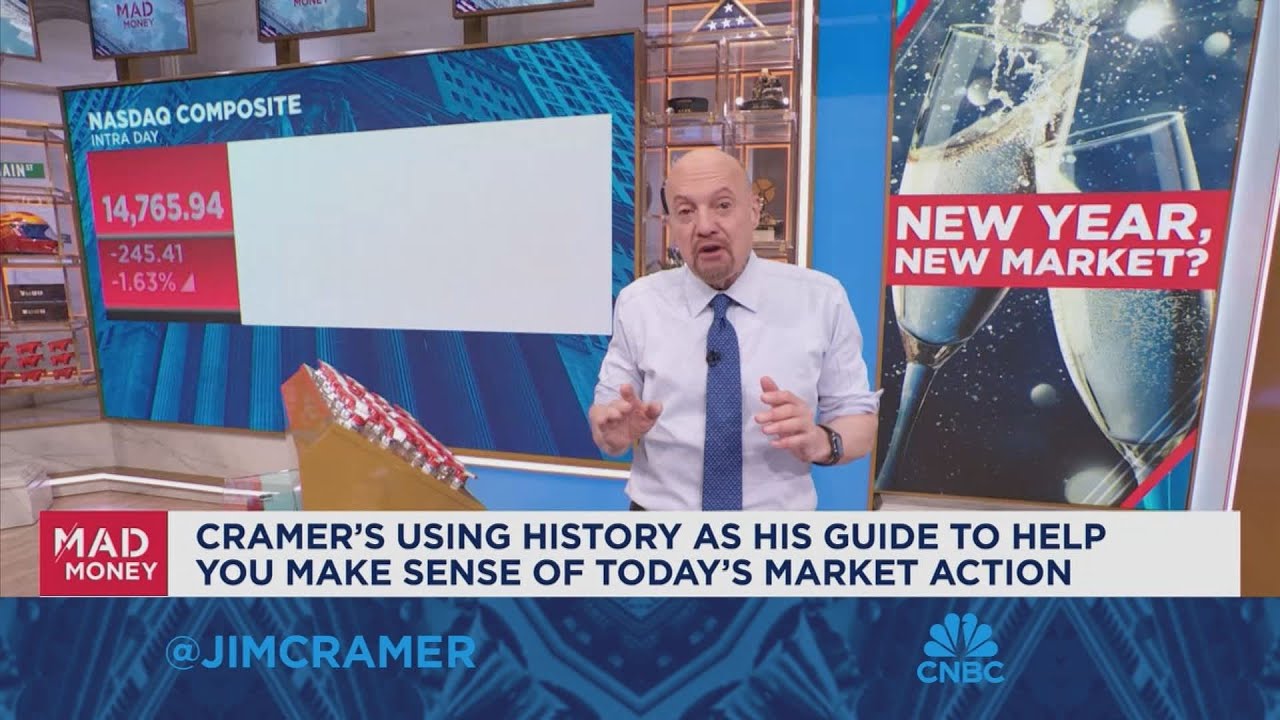

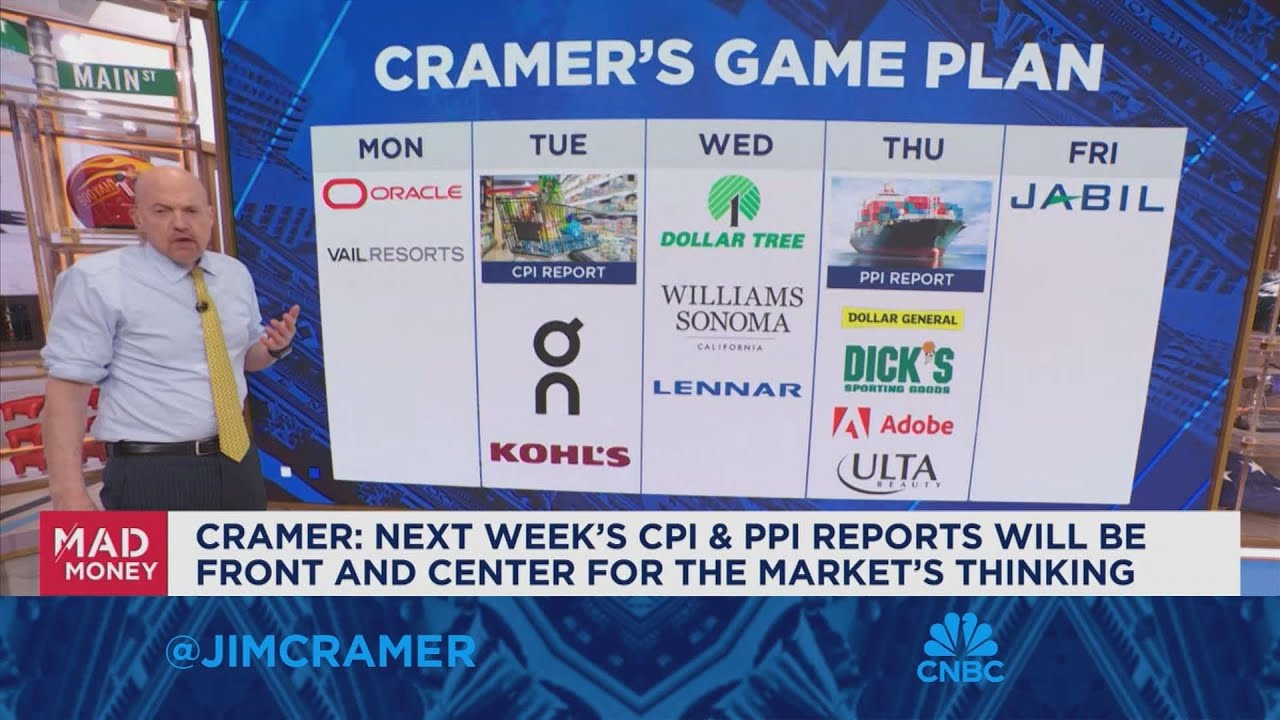

Apple and Invidia are the only two stocks that Jim Cramer says own dont trade, but he also said this week there could be some short term pain ahead for both. Invidia could break $1000, but I think it will see some selling before it does.

He also says 5% of a portfolio should be invested in Gold, as an insurance policy for when instability hits the economy and the market. Some people like to do 2.5% Gold, and 2.5% Cryptocurrency as a hedge. I personally think while Crypto is highly lucrative now, you should only invest money in it you are willing to and want to lose (Casino money). Where Bitcoin goes is anyones guess, I think it is asset that provides utility that is trading in a Bubble, watch the 66,666 level, that seems to be a line in the sand where it could do a big move up or down from.

Cramer said it would not shock him if Gold prices hit $2,600 in the not to distant future. Gold has had a big run, along with Bitcoin, which to me is a bit concerning (a canary in the coal mine), and a possible sign that uncertainty and risk may be re-entering the market.

These past few years America saw the worst Inflation data in over 3 decades. While its derivative has subsided, its still high, and I think hurting middle and lower income consumers.

Biden said today you ‘may’ see rates come down soon, which typically is a bullish sign. Fed meets in less than 2 weeks to decide.

I have no clue where the Housing Market is going, but I am worried that it has seen close to a 6% increase year over year, over the past few years. Would be very interested in hearing forecasts from the professionals you follow on the housing markets.

Another statistic to pay attention to is people who do not have any savings, and are living pay check to pay check:

Worries aside, here is the bright side:

If you are investing for the long term, these pull backs, and future Bear markets offer the best buying opportunities, (if your time frame is in decades). Cramer in his books recommends Dollar Cost Average when you buy into the selling.

The long term average yearly gains of the S&P 500 are about 11%. This is why all young and middle aged people should have some type of retirement money invested in the market. Talk to a Financial Professional about this trend.

I am prejudiced and I may be delusional on this thought, but I believe not paying attention to the economy and forces that hurt it, is a form of Spiritual Bypassing.